"Annuity" refers to an insurance contract issued and distributed by financial institutions with the intention of paying out invested funds in a fixed income stream in the future for a certain number of years or a lifetime.

Tax Implications:

- The death benefit from a life insurance policy is not subject to income tax.

- Heirs dont have to pay taxes on the money.

- The money policy goes directly to the beneficiaries you have named on the policy, not to your estate.

- Funds do not have to go through probate or pay off any outstanding debts before reaching your beneficiaries.

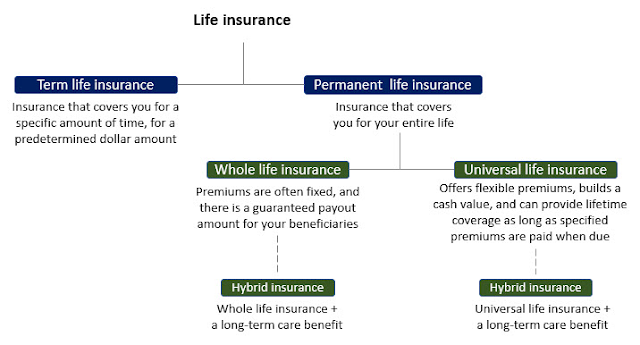

Life insurance generally falls into 2 categories: Term and permanent:

Summarized differences between term, whole, universal, and variable life insurance options in USA:

| Feature | Term | Whole | Universal | Variable |

|---|---|---|---|---|

| Death benefit | Guaranteed as 1-time lumpsum | Guaranteed in a lump sum or in installments. | Guaranteed in a lump sum or in installments. | Guaranteed in a lump sum or in installments. |

| Premiums | Low | High & Fixed | Variable. You must pay at least enough to cover the cost of insurance and the administration charges. | Variable |

| Cash value | None | Guaranteed | Guaranteed or variable | Variable |

| Investment options | None | None | Limited | Varied |

| Surrender charges | No | Yes or no | Yes or no | Yes |

| Tax treatment | Tax-deferred | Tax-deferred | Tax-deferred | Tax-deferred |

| Pros | Affordable, short-term coverage to give your loved ones a lump sum to help replace the loss of your income | Guaranteed death benefit, guaranteed cash value, low fees. eligible to earn dividends based on the company's earnings. | Flexibility, death benefit can be increased, cash value can be used for loans or withdrawals | Investment options, potential for higher returns |

| Cons | Temporary coverage, death benefit can decrease if premiums are not paid | High premiums, low investment returns. | Higher premiums than whole life, death benefit can decrease if cash value is withdrawn | Potential for losses, higher fees than whole life |

References: