Following are all the ways in which you can reduce your yearly taxable income:

PROTIP Section 0: Use your standard deductions

This depends on your marital status and number of dependents.

File your taxes ASAP as that starts your Audit timeline early

If your tax return does have errors, the timeframe in which the government has to prove your fault starts decreasing earlier.

PROTIP Section 1: Maximize Pre-Tax & Post-tax Contributions

A) Retirement plan (PRE-TAX) for yourself:

401k from employer &/or self created IRA for self:

If you are age <50: $23k/yr = $2k/month

If you are age >50: You can contribute an additional $6k/yr = additional $0.5k/month

B) Retirement plan (PRE-TAX) for your non-working spouse:

Self created IRA for spouse (not via employer or government):

If you are age <50: $6k/yr = $0.5k/month

If you are age >50: You can contribute an additional $1k/yr

C) Health Savings account (PRE-TAX) for healthcare expenses:

HSA from your health insurance company:

If you dont have a family and are of age <55: $4k/yr = $305/month

If you do have a family and are of age <55: $8k/yr = $600/month

If you are age >55: You can contribute an additional $1k/yr

D) Roth IRA (POST-TAX) for Forever tax free profits:

Never pay taxes on profits from Roth IRA (crypto/stocks) by contributing:

$6k/yr = $0.5k/month from your PostTax paycheck

Remember; You can withdraw your principal/initial contribution for free ANYTIME.

FINALLY; After all deductions (401k, Spouse-IRA, HSA, Roth IRA) -

- Your PostTax income will reduce by a total of $29k/year = $2.4k/month

- This reduces your total tax load by $8.7k/yr which yields a profit of 40%+ 😎

- This 40% profit is achieved by paying $8.7k/yr lesser taxes vs only a $20.3k reduction in post tax income.

- Every dollar saved in taxes is equal to 1.3x in salary terms. $8.7k saved means ($8.7*1.3x) = $11.3k of salary gained/saved.

- By having untaxed money in these old-age/health accounts, you maximize your principal/initial investment to gain profits from these as much and as early as possible.

OTHER PRE-TAX DEDUCTIONS:

- Healthcare, Dental & Vision Insurance Cost

- Medical Expenses and Flexible Spending Accounts

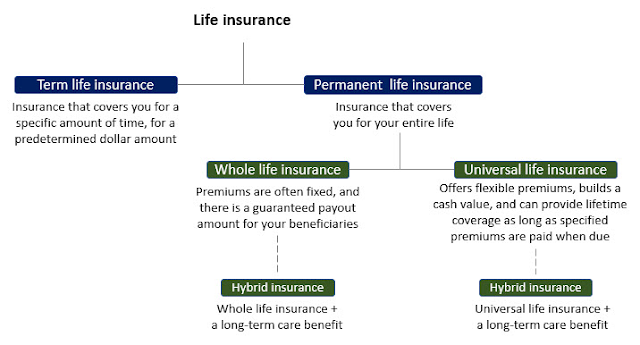

- Life & Supplemental Insurance Coverage

- Short-Term & Long-Term Disability

- Child Care Expenses

- Commuter Benefits

PROTIP Section 2: Maximize Non-taxable income

(no need to add these to your tax return)

- Inheritances, gifts and bequests

- Cash rebates on items you purchase from a retailer, manufacturer or dealer

- Alimony payments (for divorce decrees finalized after 2018)

- Child support payments

- Most healthcare benefits

- Money that is reimbursed from qualifying adoptions

- Welfare payments

- Money you receive from a life insurance policy when someone dies

- Money from a qualified scholarship for non-personal expenses

- Credit card bonuses/cashbacks

- Retail gift cards

PROTIP Section 3: Get Married

(If you're legally married as of December 31 of the tax year, the IRS considers you to be married for the full year.)

A) Reduce Taxable income by filing taxes jointly to get a Marriage Bonus:

if the taxpaying spouses have substantially different salaries, or if only one spouse earns; the lower one can pull the higher one down into a lower bracket, reducing the couples' overall taxes.

B) Use Spouse's business loss as a tax write-off on a jointly filed tax return:

Spouse who’s losing money – say, in business - may not be able to take advantage of some deductions, including those dealing with the house. The spouse who’s making money may be able to take those unused tax deductions and claim the other’s loss as a tax write-off on a joint return.

C) Use Spouse's income to increase Total IRA contributions:

Couples filing jointly can make contributions to two separate IRA accounts – one for each spouse where the unemployed spouse (taxpayer with SSN), can contribute to an IRA using their spouse's income.

D) Increase primary residence sale tax-free profit limit from $250,000 to $500,000:

To qualify for the larger $500,000 tax-free gain, both spouses must have lived in the home for at least two of the last five years, and at least one spouse must have owned the home for at least two of the last five years.

BONUS: Potential tax-related drawbacks after getting married:

1) If filing jointly:

- Marriage penalties typically occur when the tax brackets, standard deductions, and other aspects of the tax code available to married couples aren't double those available to single taxpayers.

- Once you sign the joint return, you are fully responsible for every number that’s in it. If your spouse fudges a figure, you’re equally liable for the consequences.

- However, you aren’t responsible for your spouse’s mistakes or deliberate omissions if they happened in the years before you married or if you can prove that you didn’t know about them.

- It might be harder to reach the higher minimum percentages of income necessary to be able to deduct medical expenses (in 2022, it must be greater than 7.5% of Adjusted Gross Income), given the combined income, unless one or both of you had significant health care expenses.

- If there’s a garnishment for an unpaid loan or child support against a spouse, a refund could be delayed or blocked.

2) If filing separately:

PROTIP Section 4:Other lesser-known Deductions:

A) Deduct your house loan interest payments:CONDITION 1: You need to have a house loan active in USA.

CONDITION 2: You need to be making payments towards your loan interest for this deduction.

CONDITION 3: You can only deduct the loan interest paid in the previous/taxable calender year

B) Claim both your parents as dependents:

CONDITION 1: Your parents/dependents will need their ITIN numbers for you to claim this deduction.

CONDITION 2:If your parents/dependents are immigants, they have to stay with you at your home for minimum 6 months for you to list them as dependents on your tax return for that year):

C) S corp deductions:

CONDITION 1: Only If you are a consultant or have your own firm/business.

CONDITION 2: You can only deduct your work related expenses and firm/business losses from your taxable income.

CONDITION 3: If you have made taxable profits from your firm/business, you need to find the net loss/profit and report the same to the IRS.

D) Transfer assets to spouse tax free after death:

CONDITION 1: You can leave any amount of money to a spouse without generating estate tax. CONDITION 2: This protects the deceased’s estate from taxation only until the surviving spouse dies.

E) Section 1031 exchange: Defer capital gains taxes on the sale of real estate

CONDITION: if you reinvest the proceeds into another piece of real estate of equal or greater value.

F) Section 121 exclusion: Exclude $250k-$500k of capital gains tax on the sale of your primary residence

CONDITION: if you have owned and lived in the home for at least two of the past five years.

PROTIP Section 5: Other tax-deferred growth basis investments:

- U.S. savings bonds: U.S. savings bonds are a type of government bond that offers tax-deferred growth. When you buy a U.S. savings bond, you pay a discounted price, and the bond matures at a higher price. The difference between the purchase price and the maturity value is the interest you earn on the bond. Interest on U.S. savings bonds is not taxed until the bond matures or you cash it in.

- Series EE savings bonds: Series EE savings bonds are a type of U.S. savings bond that offer a guaranteed rate of return. The rate of return is fixed when you buy the bond, and it does not change over time. Series EE savings bonds are a good option for investors who are looking for a safe and secure investment with a guaranteed rate of return.

- Series I savings bonds: Series I savings bonds are a type of U.S. savings bond that offer a variable rate of return. The rate of return is composed of a fixed rate and a variable rate that is indexed to inflation. Series I savings bonds are a good option for investors who are looking for an investment that will keep pace with inflation.

- Treasury Inflation-Protected Securities (TIPS): TIPS are a type of U.S. government bond that is indexed to inflation. The principal amount of a TIPS bond increases with inflation, and the interest payments are also adjusted for inflation. TIPS are a good option for investors who are looking for an investment that will keep pace with inflation.

- Municipal bonds: Municipal bonds are bonds issued by state and local governments. Interest on municipal bonds is typically exempt from federal income tax, and it may also be exempt from state and local income tax. Municipal bonds are a good option for investors who are looking for a tax-advantaged investment.

- Real estate investment trusts (REITs): REITs are a type of investment that invests in real estate. REITs can be a good option for investors who are looking for a tax-advantaged investment that can provide income and growth by offering a qualified (lower) dividend tax rate. To qualify for the qualified dividend tax rate, the dividends must be paid by a U.S. company or a REIT.

- 0% for taxpayers in the 10% or 12% tax bracket.

- 15% for taxpayers in the 22% or 24% tax brackets

- 20% for taxpayers in the 32%, 35%, or 37% tax brackets

Disclaimers:

- All info listed above is for informational and educational purposes only.

- Info may change from year to year. Info listed here might be out-of-date.

- This list is not comprehensive. It is provided to you with the understanding that we are not engaged in rendering tax advice.

- The information provided is not intended to be used to avoid federal tax penalties.

Hashtags:

#personalfinances #retirement #401k #retirementplanning #financialplanning #employeebenefits #tax #lifeinsurance #pensions #taxes #taxdeductions #taxlaws #insurance #healthinsurance #pension #taxbill #taxincentive #finance